Build a Data-Driven ICP to Target B2B Buyers on LinkedIn

Stop guessing your ICP. Use sales data to build a smarter LinkedIn Ads strategy, drive high-intent B2B leads, and optimise your total addressable market (TAM).

According to research from Heinz Marketing, the average B2B company rates its target-market maturity at just 2.4 out of 5. Translation? Most B2B marketers are still building their Ideal Customer Profile (ICP) based on vibes, not validated sales data.

Pipeline scores by B2B companies

That’s a huge missed opportunity.

In this guide, we’ll show you how to:

- Build a data-driven ICP based on closed-won deals

- Identify shared traits across your best B2B customers

- Translate those insights into a high-ROI LinkedIn targeting strategy

- Build a Total Addressable Market (TAM) that powers predictable growth

Why Data-Backed ICPs Outperform Guesswork

If most B2B companies are still building their ICPs on assumptions, the opportunity lies with the few that don’t.

When your ICP is grounded in CRM and revenue data, it becomes more than a marketing document, it becomes a growth lever.

Instead of chasing anyone who might buy, you can now focus your LinkedIn Ads and content marketing on companies that:

- Close faster and require less nurturing

- Have higher LTV or deal size

- Are easier to serve profitably

- Renew and expand with minimal friction

That’s where your advantage compounds.

With every deal, your data gets smarter, and so does your targeting strategy.

Step 1: Let Sales Data Shape Your ICP

You don’t need fancy intent data or a RevOps team to build an effective ICP. If you’re a small-to-mid-market B2B company, your CRM should be the goldmine.

I say “should” because, too often, it doesn’t.

Not because the data isn’t there, but because teams aren’t capturing it consistently or using it well. Whether it’s incomplete properties, missing fields, or skipped QA, the quality of your insight is only as good as the quality of your inputs.

It’s a cliché for a reason: what gets measured gets managed.

First, clean your CRM:

- Standardise fields (e.g. industry, company size, deal source)

Fix missing or inconsistent entries - Ensure win/loss reasons and sales stages are clearly defined

A messy CRM leads to flawed insights. Clean data = clean ICP.

Next, analyse your past 12–24 months of deals:

Pull these core metrics:

- Win rate by industry or segment

- Average deal size or customer lifetime value (LTV)

- Sales cycle length

- Company size (employee count or revenue)

- Job roles of decision-makers

- Lead source and deal stage velocity

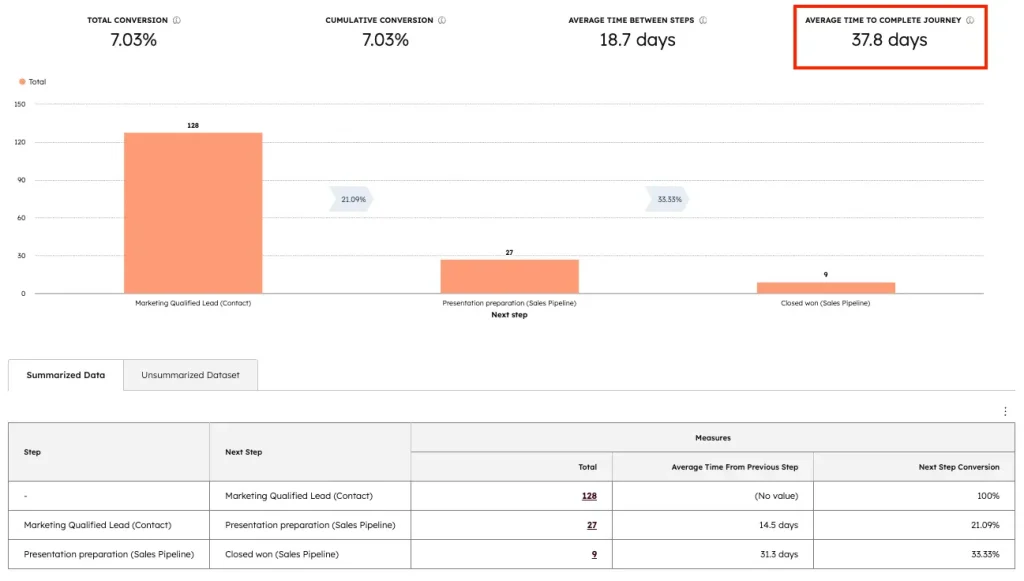

37 days from MQL to deal closed won

Then, ask the right questions:

- Who closes the fastest?

- Which accounts deliver the highest contract values?

- Who churns the least?

- Which verticals are easiest to sell into?

At Farsiight, we ran this analysis on our client base and found that:

“B2B companies in Australia and New Zealand with 10+ employees had the highest LTV and longest retention.”

That insight allowed us to refocus our LinkedIn and content strategy on a tighter, higher-fit audience, instead of chasing everyone.

Step 2: Spot Patterns Across Your Best Customers

Once you’ve zeroed in on the customers who deliver the most value, zoom out and look for what they share in common.

This is where you translate numbers into patterns, and patterns into strategy.

Go beyond basic firmographics. The best ICPs blend quantitative traits (what they look like on paper) with qualitative signals (how and why they buy).

Here’s how to think about it:

- Trigger events: What prompted them to reach out? A funding round, team expansion, product launch, or new regulation?

- Pain points: What business challenges were they actively trying to solve? We take these from our fact-finding sheets.

- Buying mindset: Were they looking for a partner or a quick fix?

- Sales experience: What made these deals smoother, faster consensus, better-fit stakeholders, or clear urgency?

Example of how we collect pain point data from B2B companies

If you can identify even three or four shared attributes among your best customers, you have the foundation of a data-backed ICP.

From there, it’s not just a marketing persona, it’s a living profile that informs everything:

- Your LinkedIn Ads targeting

- Your ad creative and messaging strategy

- Your sales prioritisation and outreach sequencing

High level process of how your CRM data translates to targeting

This shift from “who we think we serve” to “who the data proves we serve best”, is what separates the average B2B marketer from a performance-driven one.

Step 3: Turn ICP Insights Into a Targeted TAM List

Once you know what your ICP looks like, the next step is to find more companies just like them, and target them through LinkedIn Ads.

That’s your Total Addressable Market (TAM) , a list of companies that match your ICP based on real sales data, not assumptions or LinkedIn’s “interests” filters.

When you upload a TAM list as a LinkedIn Matched Audience, you’re no longer paying for broad impressions, every ad is being shown to companies that actually fit your ICP. That means better lead quality, less wasted spend, and more efficient demand generation.

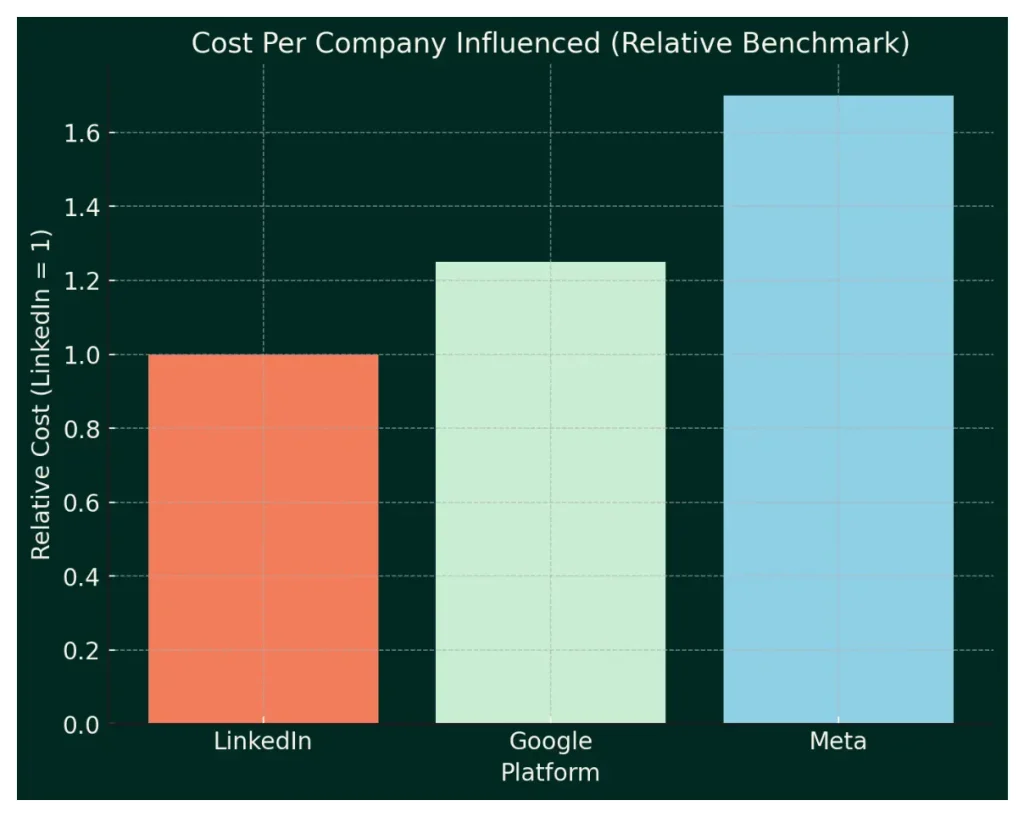

And yes, LinkedIn CPCs look high compared to Meta or Google.

But when you measure what actually matters in B2B , cost per company influenced , LinkedIn becomes the most efficient channel.

From the Dreamdata LinkedIn Ads Benchmark Report (2025):

- LinkedIn has the lowest cost per company influenced of any major platform

- Meta is ~70% more expensive

- Google Search is ~25% more expensive

Google and Meta are ~25% and ~70% most expensive

So while you might pay more per click, you’re actually paying less to get in front of the right companies , the ones who can buy from you.

Your TAM list is the bridge between ICP theory and pipeline reality.

According to Avaus, brands using first-party data see an 8× ROI, over 25% lower CPA, and up to 2.9× revenue growth

Step 4: Use Your ICP to Optimise LinkedIn Ads

Once your TAM is ready, use your ICP insights to shape every part of your LinkedIn campaign strategy:

- Focus only on ICP-matching accounts using Matched Audiences

- Reflect their challenges, buying triggers, and pain points

- Use a mixture of thought leadership ads, conversation ads, document ads, etc to convery specific types of messages throughout the journey.

- Align ad sequences with buyer journey stages. For example, you don’t typically show social proof at the top of the funnel.

Wrapping It Up

Your ICP isn’t a static document, it’s a living asset that should evolve as your market, product, and customer base evolve.

Every 6–12 months, revisit your closed deals, analyse which segments are still delivering the highest LTV or fastest sales cycles, and adjust your ICP and TAM list accordingly. Remove companies that no longer fit, add new ones that mirror your best-performing clients, and make sure sales and marketing stay aligned as new patterns emerge.

If there’s one shift worth making, it’s this.

Stop defining your ICP on assumptions. Use your sales data to spot repeatable patterns, turn those into a data-backed ICP, and build a TAM list of companies that actually match it.

When you build your ICP from sales outcomes, targeting stops being guesswork. It becomes a system, focused, efficient, and built to compound.

Want help building your ICP and TAM strategy?

Get a free B2B growth plan and unlock faster B2B growth powered by data.

FAQs

A data-driven Ideal Customer Profile is based on actual sales and CRM data, not assumptions. It reflects your highest-LTV, fastest-closing customers.

Once you understand who your ICP is, use third-party platforms like Clay to build the lists. You'll need to cleanse them leveraging AI and manual intervention to ensure every company in your list matches your ICP.

LinkedIn lets you upload first-party data using matched audiences to target your exact ICP. While CPCs are higher, cost per influenced company and lead quality is unmatched for B2B.

Ben Somerville

Ben is our Director at farsiight, with over 15+ years experience in B2B.

Like what you read?

Learn more about digital, creative and platform strategies below.