Why B2B Companies Measure LinkedIn Ads Wrong (and What to Track Instead)

Too many B2B marketers treat LinkedIn like a short-term performance channel. The truth is, LinkedIn campaign performance is often misjudged because its value shows up quarters later through influenced deals and opportunity creation. In this article, we break down how to measure what actually matters: aCAC, LinkedIn lead attribution, and the conversations that compound into long-term growth.

“You don’t scale pipeline by chasing cheap clicks, you scale it by chasing the right conversations.”

B2B companies are investing more than ever into LinkedIn Ads, but many are still measuring LinkedIn Ads performance using outdated or incomplete attribution models. Understanding how to measure LinkedIn Ads correctly is essential to scaling your demand gen efficiently.

Here’s the reality: B2B journeys aren’t measured in weeks, they’re measured in quarters.

Dreamdata’s 2025 data shows the median B2B journey takes about 211 days from first touch to closed-won, and when LinkedIn Ads is the first impression, revenue often shows up ~320 days later.

Screenshot from 2025 LinkedIn Ads report by Dreamdata.io

If you judge with 7–28 day platform windows, you’ll kill the very campaigns that create your future pipeline.

The Real ROI of LinkedIn Ads in B2B Marketing

Before you join the “LinkedIn is too expensive” chorus (we’re guilty of saying this ourselves in the past), look at the broader picture of B2B ad ROI.

Across aggregated B2B marketing data, LinkedIn Ads is the only major ad network showing a positive ROAS (~113%), now capturing 39% of total B2B ad budgets.

Costs per click may be higher, but the commercial outcomes are stronger when you zoom out beyond vanity metrics.

The problem with “good” LinkedIn metrics

Platform numbers are designed for short-term optimisation, not long-cycle buying:

- CTR/CPM may look “good,” but they don’t tell you if impressions hit the right companies or contacts. Without the right Linkedin Ads audience strategy, your entire strategy fails.

- In-platform conversions undercount demand generation metrics because cookies lapse, and most buying happens long after the first touch.

- 95:5 reality: roughly 5% of buyers are in-market now; 95% aren’t. If you judge LinkedIn Ads by immediate conversions or basic LinkedIn ad conversion tracking, you’ll underfund the very channel that builds tomorrow’s pipeline.

Signals, not scores

At farsiight we treat platform metrics as signals, not scores:

- The goal isn’t the lowest CPM; it’s the right impressions on ICP accounts, and whether those accounts show up in the pipeline later.

- We care more about cost per company influenced than cost per click. Dreamdata’s data consistently shows LinkedIn Ads outperform other B2B marketing channels on company-level efficiency and ROAS.

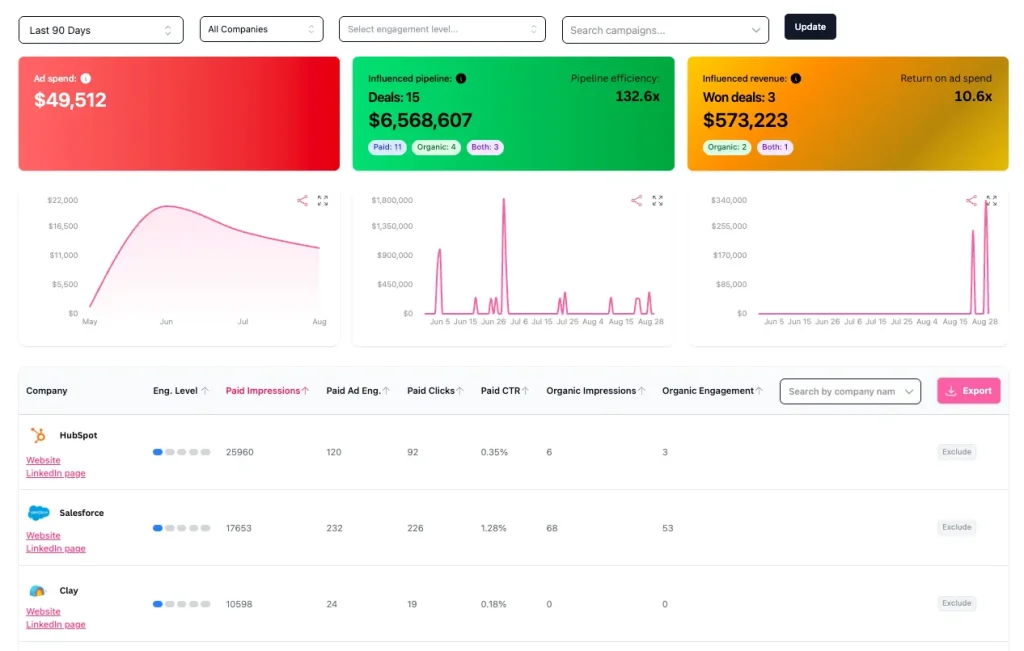

How we measure LinkedIn (our stack)

- HubSpot is the source of truth for deals and revenue.

- Fibbler matches company-level LinkedIn ad/organic exposure to the companies and opportunities in our CRM to quantify influenced pipeline (awareness, engagement, intent models).

- LinkedIn Ads platform metrics gives us creative diagnostics and buying controls, not “truth,” just signals to improve our messages and pacing.

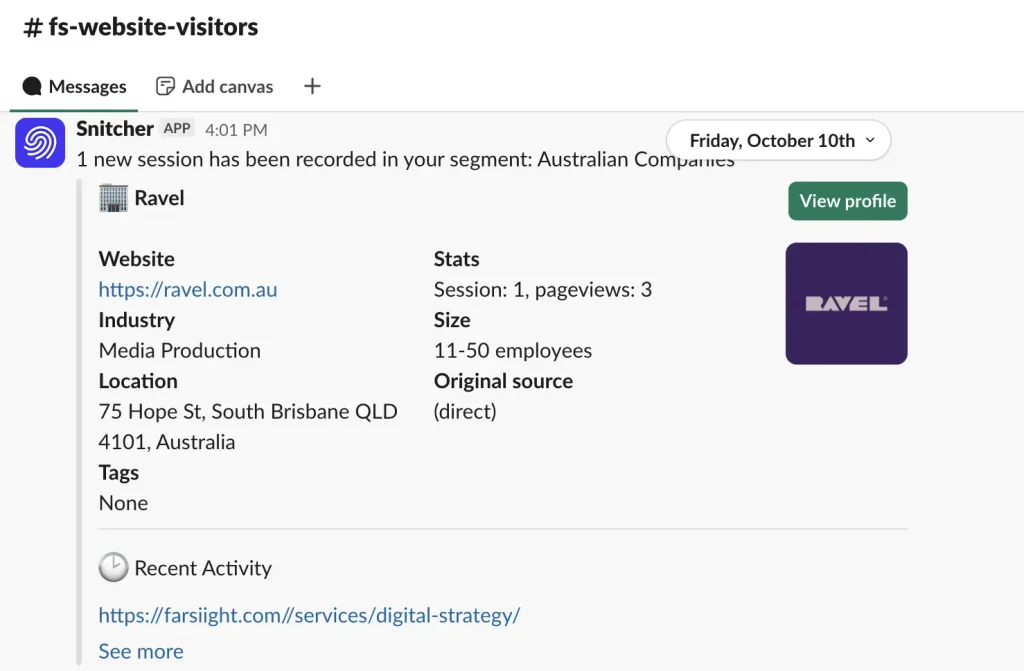

We also run a “How did you hear about us?” field to support attribution modelling for B2B (are they from our target lists?), plus Snitcher to see which target accounts hit the site. These are the early hints that awareness is turning into momentum.

Collect your own 1st-party data on what your customers say about where they heard about you

The right metrics to run LinkedIn by

- Influenced pipeline (value & %)

Are the companies exposed to your ads later appearing in pipeline, opportunities, and revenue? Dreamdata’s 2025 dataset shows LinkedIn Ads influences a large share of MQLs/SQLs/New Biz in typical B2B journey, even if the first exposure was months earlier.

Fibbler screenshot showing influenced pipeline

- aCAC (blended)

We calculate CAC across channels because the buyer’s path is multi-touch and multi-month. Judging LinkedIn Ads in isolation by last-click is how good demand gen gets turned off.

- MQL quality (company match rate)

We validate whether MQLs actually map to our account lists and ICP (not just “more leads”). Frequency and engagement quality tell us when to refresh creative to stay relevant within ICP, not the whole platform.

What we watch weekly (leading indicators)

- Creative engagement quality (comments, saves, profile visits, qualified replies, landing page views), not just CTR.

- Frequency on ICP segments enough repetition to build memory; refresh when engagement/efficiency decays on the same audience, usually recycling creative every 1-2 months.

- Company match rate on MQLs and site visitors (Snitcher), are we penetrating our real account lists or just “getting traffic”?

Benchmarks are useful for context (CTR/CPM ranges vary by industry and format), but we treat them as sanity checks, not success criteria. Your North Star is pipeline and aCAC, benchmarks just help you triage creative and pacing.

A quick story (why this matters)

A billion-dollar company recently told us “LinkedIn isn’t working, zero conversions in-platform.” If you only looked inside Campaign Manager, you’d agree. On paper, our own farsiight numbers sometimes look “bad” (we’ve seen $3k+ CPLs on certain sequences).

But through our HubSpot↔Fibbler lens, those impressions and engagements show up later as qualified opportunities from the exact accounts we care about. It’s not the platform; it’s the measurement window and the unit of analysis.

The 30-Minute LinkedIn Ads Measurement Reset

- Add an influenced-pipeline view. Leverage a platform like Fibbler to start understanding how much of your pipeline has been influenced by LinkedIn views.

- Report aCAC + opportunity creation alongside in-platform engagement metrics. Put commercial metrics next to platform signals in the same weekly view, but understand how they should each drive different behaviour.

- Track company match rate + frequency for your target lists. Refresh creative when engagement per 1,000 impressions drops for the same audience.

- Stop judging LinkedIn by last-click. The median B2B journey is ~211 days; impression-to-revenue from LinkedIn averages ~320 days. Build your dashboards for quarters, not weeks.

Zoom Out Before You Optimise

LinkedIn Ads isn’t broken, the way we measure it is.

If you only look at short-term metrics, you’ll never see long-term growth. When you start measuring influenced pipeline, aCAC, and company-level impact, the story changes completely.

At farsiight, we’re not chasing cheaper clicks. We’re chasing better conversations with the right people, and that’s what compounds into real growth over time.

Because the best B2B marketers don’t optimise for impressions.

They optimise for impact.

FAQs

Use CRM integrations (like Fibbler) and offline conversion tracking to link ad clicks with actual pipeline activity and revenue.

Multi-touch attribution (especially position-based models) often gives a more complete view than last-click.

Improve audience targeting using your CRM data, refine your creative based on funnel stage, and use matched audiences.

LinkedIn tracks conversions using cookies and may not capture long sales cycles or offline activity, making CRM data critical.

Josh Somerville

Josh is the co-founder of farsiight and has spent the past 12 years scaling PPC campaigns.

Like what you read?

Learn more about digital, creative and platform strategies below.